Top 5 Quantum Computing Stocks Investors Are Buying Now

Quantum computing is gaining attention in tech and investment circles. As companies race to build machines that solve problems faster than traditional computers, investors are watching closely. Stocks in this space are moving quickly, and many see them as early opportunities with strong long-term potential.

Table of Contents

What Are Quantum Computing Stocks?

These stocks represent companies working on machines that rely on qubits, not bits. Qubits allow computers to process information differently, unlocking new problem-solving capabilities. Fields like cybersecurity, logistics, and drug research stand to benefit first.

Some firms build entire quantum systems. Others focus on software or cloud access. A few major tech players integrate quantum into larger platforms. What links them is the potential. Research groups estimate quantum could bring in trillions in value within ten years.

Why Quantum Stocks Surged Recently

Momentum in the quantum sector isn’t random. Quantum Computing Inc. climbed over 3,000% in 12 months. Rigetti saw a sharp boost after Nvidia’s CEO highlighted quantum’s role in tech’s future. IonQ also jumped, with its price more than tripling last year.

Multiple drivers are behind the surge. Quantum’s link to artificial intelligence brings attention. Organizations are forming alliances with Google, Microsoft, and Amazon. Credibility is increased by government contracts and university research agreements. And with markets seeking the next big leap, quantum delivers excitement.

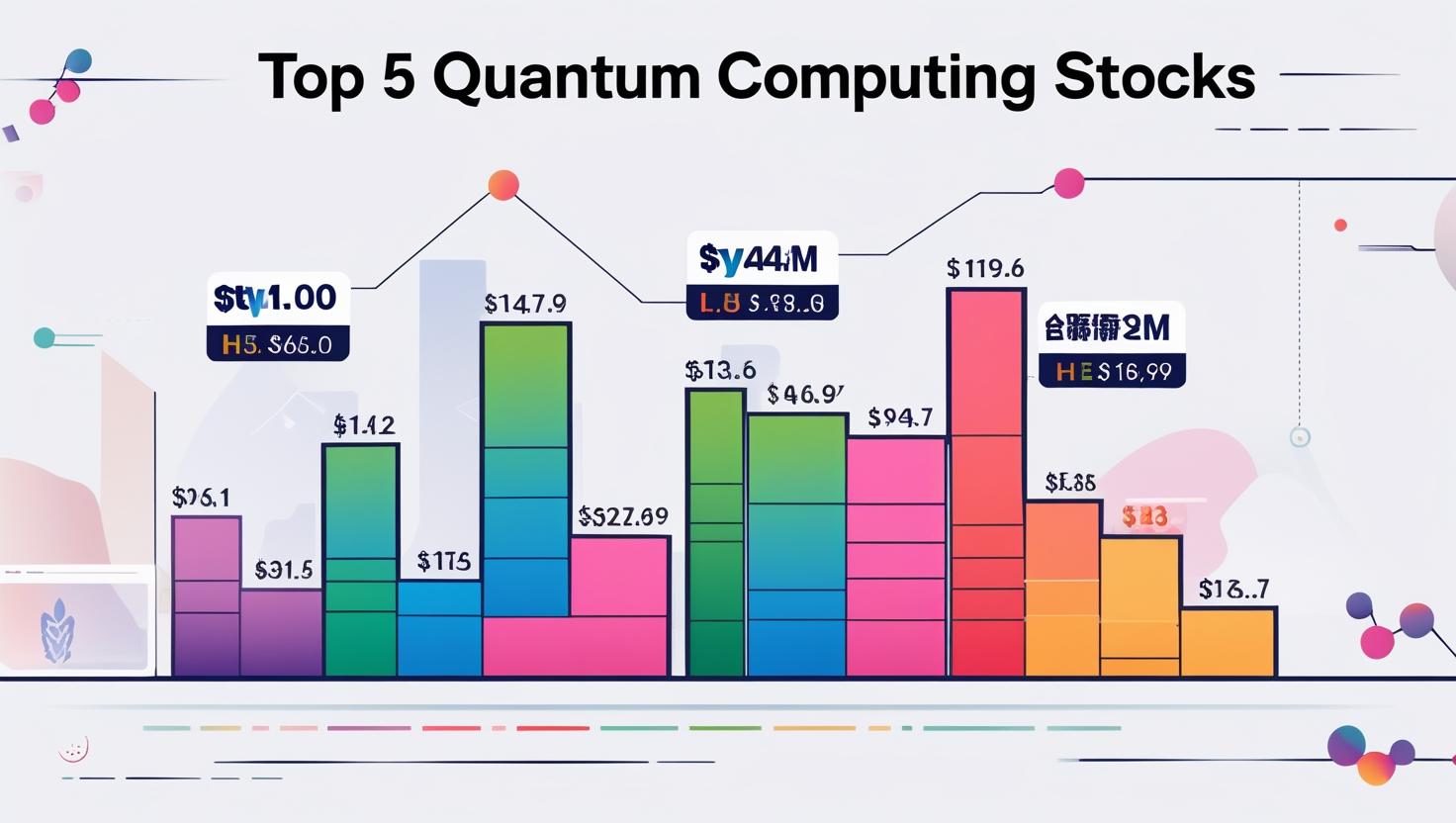

Meet the Top 5 Quantum Computing Stocks

IonQ (NASDAQ: IONQ) uses trapped ions to build scalable quantum systems. Their machines are available through Amazon, Google, and Microsoft. Recent financials showed $7.6 million in revenue, with narrowed losses. The stock rose nearly 290% this year alone.

D-Wave Quantum (NYSE: QBTS) takes a different route. Its annealing systems are designed for real-world optimization problems. Their new Advantage2 platform delivers over 4,400 qubits. In one year, D-Wave grew its revenue by over 500%. The company still needs to secure its long-term funding path.

Rigetti Computing (NASDAQ: RGTI) builds systems using superconducting qubits. Their Forest platform gives developers access through the cloud. Rigetti’s stock rose 40% after Nvidia’s public statement. While gains were quick, sharp drops are always possible.

Quantum Computing Inc. (NASDAQ: QUBT) works on integrated photonics and security tech. They develop hybrid machines and encryption tools. QUBT’s stock exploded by over 3,000% in a year. However, commercial success still depends on adoption and use beyond labs.

Nvidia (NASDAQ: NVDA) is not a quantum-only company. Still, it plays a central role by supporting quantum research and integration. Their platforms connect AI and quantum, offering indirect exposure with less risk. Nvidia partners with top players and funds multiple research paths.

Understanding the Risks (And the Rewards)

These stocks bring potential, but also uncertainty. Most companies here are not yet profitable. They rely on funding and faith in future breakthroughs.

Stocks like QUBT and Rigetti can gain or drop by double digits in a day. Bigger companies like Nvidia offer steadier growth but less upside from quantum alone. Investing here means betting on what’s next, not what’s proven. Some wins could be large—but the risks match.

Pure-Play vs Tech Giant: What’s Smarter?

Depending on your risk tolerance, you can choose between small businesses and tech giants. Pure-play businesses that only concentrate on quantum include IonQ and Rigetti. Higher growth opportunities result from this, but it also leaves them open to delays or technological obstacles.

Tech giants like Microsoft or Nvidia offer balance. They’re involved in quantum but have income from other areas. This keeps the stock stable. Many investors mix both buying small shares in pure players and holding larger ones in stable giants.

Key Quantum Trends Investors Should Track

Quantum tech evolves fast. Investors should follow a few signals.

Keep an eye on companies improving qubit performance. Better results with fewer errors mean real progress. Watch for major deals, quantum computing stocks, like IonQ’s with Airbus. D-Wave’s ties to universities also matter. Governments are spending heavily, which adds support to the space. Also, look at new funds. ETFs like QTUM offer a way to invest across multiple companies with one buy.

FAQs

Are quantum computing stocks safe?

They carry high risk. Most are unprofitable and respond sharply to news. Invest carefully.

What makes IonQ different from Nvidia?

IonQ focuses only on quantum hardware. Nvidia works across AI and chips but supports quantum projects.

When will quantum computing be usable?

Wider use is expected within five to ten years, though development is ongoing now.

Can I invest in all of them at once?

Yes. ETFs like QTUM include a mix of quantum-related stocks for easier access.

Conclusion

Quantum stocks are gaining attention for good reason. Companies like IonQ, Rigetti, and QUBT are pushing the edge of computing. Others like Nvidia support the space while reducing investor risk. Quantum won’t go mainstream overnight. However, as development continues, the businesses in this sector may emerge as the tech leaders of the future. This industry merits being on your radar, regardless of whether you’re buying now or keeping a close eye on it.